Tailored digital design encompassing branding, advertising, communications, and web solutions.

Nordic Business Forum

PR & MEDIA | COMMUNICATIONS | EVENTS | INVESTOR RELATIONS

Amplifying business thought leadership on a global scale.

Newcastle University

SYSTEM INTEGRATION | HUBSPOT | INBOUND MARKETING | SERVICE HUB

A single source of truth led to a €2.5M return on investment.

Origin by Ocean

REGENERATIVE BRANDING | PR & COMMS | WEBSITE | UX&UI

From sustainability startup to a sensation set to transform the worldwide chemical industry.

Velux

INBOUND MARKETING | CONTENT | HUBSPOT | ORGANIZATIONAL DESIGN

Customer-centric lead generation gave the Danish roof window and skylight maker global readiness to do in-house marketing.

Opposites Attract

MARKETING TREND REPORT 2024

Avidly dissects future trends and their countertrends.

Avidly enters APAC with Hype & Dexter

NEWS | GLOBAL GROWTH | HUBSPOT

The New Zealand-based agency is HubSpot's 4x APAC Partner of the Year.

Finland.fi

UX & UI | WORDPRESS WEBSITE | COUNTRY BRAND

Designing a country's window to the world.

Global #1 five years in a row

HUBSPOT GLOBAL PARTNER OF THE YEAR X5

Avidly named HubSpot Global Partner of the Year in 2023, 2022, 2021, 2020 & 2019.

Saka

ADVERTISING | BRAND EXPERIENCE | TV

How to sell cars without showing cars. Effie award-winning advertising.

Lapland Hotels

BRAND | ADVERTISING | SOCIAL MEDIA | OUTDOOR

Crafting an enchanting Arctic narrative at a strategic and tactical level.

Hexatronic

HUBSPOT CRM SETUP

A complex CRM system implemented globally and locally.

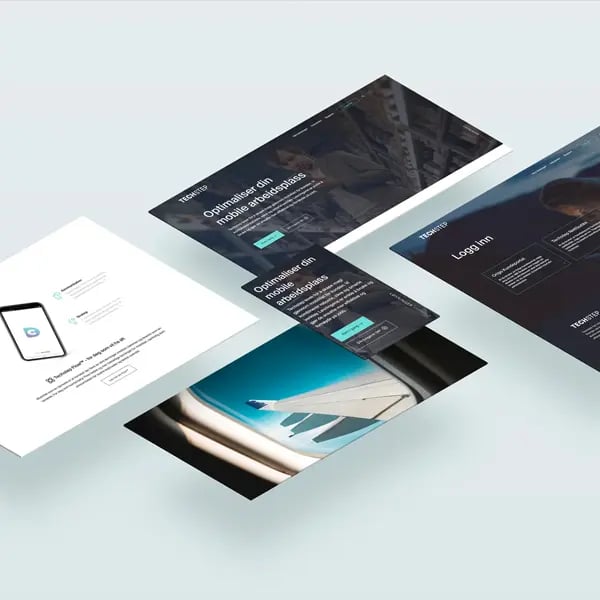

Techstep

WEBSITE | HUBSPOT CMS | UX&UI | SEO

Designing growth: +314% new visitors and a +75% conversion rate.